Note: This resource is primarily intended for individuals navigating insurance within the U.S. healthcare system. This content does not constitute professional medical advice. The information is included for informational purposes only and cannot guarantee coverage for any medical services.

Health Insurance Basics

Health insurance plans are designed to cover some or all of the costs of medical care for an individual or family. Not all plans are the same. In fact, they can differ quite a bit! Understanding some basic health insurance terminology and the answers to some common questions can help you make informed decisions about your health insurance.

In addition to reading through the information below, you can also visit the “Resources” section of this guide for links to more information on health insurance.

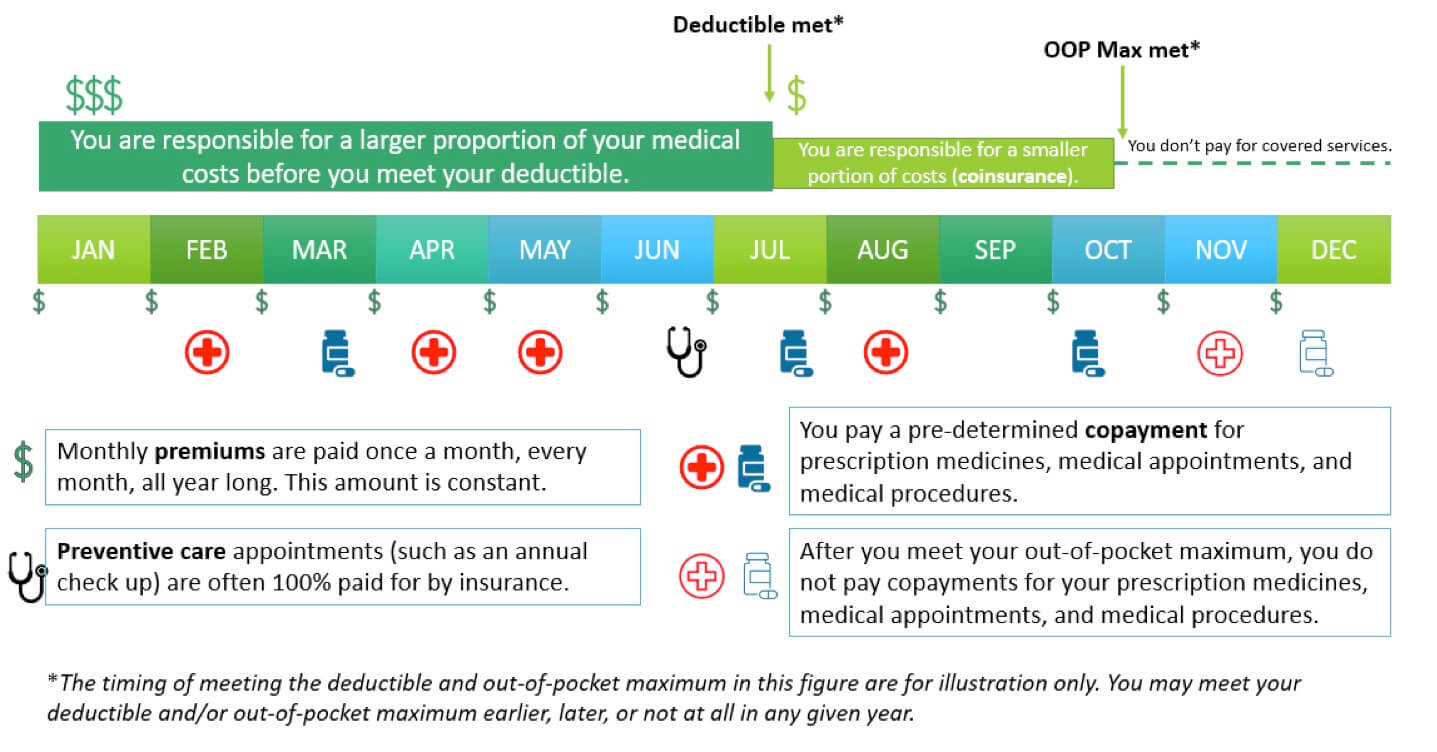

Premium: A fixed amount you pay to the insurance company each month to be covered by their plan. Premiums do not count toward deductibles or out-of-pocket maximums. If you have health insurance through your employer, they may pay part or all of your premiums for you.

Copayment (“Copay”): A fixed amount you are expected to pay for a service (for example, a doctor’s appointment or a prescription refill). You may still have a copay for these services even after you’ve reached your deductible. Your copay usually does not count toward your deductible, but it does count toward your out-of-pocket maximum.

Coinsurance: A percentage you are expected to pay for a covered service or a procedure after you meet your deductible. For example, you may be expected to pay 20% after you reach your deductible. Before you meet your deductible, you pay 100% of the cost of these services. Your insurance plan should outline which services are subject to copayments and which services are subject to coinsurance. Coinsurance applies until you’ve reached your out-of-pocket maximum.

Deductible: The amount of money you have to pay for certain covered services in a year before your health insurer starts sharing the cost. Some services may be fully covered before you meet your deductible. Copayments and premiums do not count toward your deductible. You will still share some of the cost for your medical services after you’ve reached your deductible until you have reached your out-of-pocket maximum.

Out-of-pocket maximum (OOP): The maximum amount of money you have to pay in a year before your health insurer will pay 100% of the bills for remaining covered services that year. The OOP maximum is often different for In-Network and Out-of-Network services. Your deductible, coinsurance, and copayments all count toward your out-of-pocket maximums. This only applies to covered benefits. Payment for non-covered services do not count toward your OOP maximum. Premiums do not count towards your OOP maximum.

Figure: Visual representation of health insurance costs.

Covered service: A service that is seen as medically necessary and within the bounds of your insurance agreement. Insurance plans differ in what services they cover. Covered services are not free (except in certain circumstances like preventive care); you must pay any copay or coinsurance as outlined in your insurance agreement.

Non-covered service: A service that is not medically necessary or not within the bounds of your insurance agreement. You will be responsible for the full bill for any non-covered service you receive, and it will not count toward your deductible or out-of-pocket maximum.

Preventive care: Services such as an annual well check-up which are recommended to keep people healthy. Many preventive care services are covered 100% by insurance plans and don’t require you to pay copayments or coinsurance. Some types of common cancer screenings (such as colonoscopy or mammogram) may also be considered preventive care. Preventive screenings specific to a particular cancer syndrome, such as LFS, may not be covered to the same extent as other preventive cancer screenings recommended for the general population.

In-network: Providers and healthcare systems that have special agreements and often negotiated pricing with your insurance company. Even before you meet your deductible or out-of-pocket maximum, you cannot be billed more for an in-network covered service than what the insurance company has negotiated with the provider ahead of time. In-network providers are also known as “preferred providers” or “participating providers,” though there may be slight nuances to these terms depending on your plan.

TIP: It can often be cheaper to use in-network providers and services. Before scheduling an appointment or procedure, you can contact your insurance company to check if the provider or facility is in-network. If not, you may be able to work with your doctor and insurance company to find in-network options. Even if a facility, such as a hospital, is in-network, it does not mean that all providers at that facility are also in-network.

Out-of-network: Providers and healthcare systems that do not have special agreements or negotiated pricing with your insurance company. Expect your copayments and coinsurance to be higher for services performed out-of-network.

Preferred provider organization (PPO): PPO plans do not require you to establish care with a primary care physician (PCP) or to obtain referrals from your PCP before seeing a specialist. PPO plans typically allow you to receive out-of-network care, though they will generally expect you to pay more in those instances. PPO plans provide quite a bit of flexibility, but they also usually have higher monthly premiums and out-of-pocket costs.

Point of Service (POS): POS plans have some features of both HMO and PPO plans. They require you to establish care with a primary care physician (PCP) and may require referrals from your PCP before you can see other specialists. However, POS plans do allow some flexibility for patients to see out-of-network providers, though this will cost more than in-network.

Exclusive provider organization (EPO): An EPO plan also has overlapping features with HMO and PPO plans. They may or may not require you to establish care with a primary care physician (PCP); however, they do not require a referral in order to see other medical specialists. They typically do not cover out-of-network care. An EPO plan is cheaper than a PPO plan but may have a higher deductible.

High deductible health plan (HDHP): As the name implies, a HDHP is a health plan with a high deductible. This is currently (as of 2022) defined as a plan with a deductible of $1400 or more for an individual ($2800 or more for a family). An HDHP is most appropriate for generally healthy individuals since monthly premiums tend to be low, but costs can be high when someone gets sick, since the deductible is high. These types of plans qualify for health savings accounts (described under “Billing” below) which can help a person be prepared in the event of a high expense year.

Explanation of Benefits (EOB): This is not a bill. Your EOB is mailed to you from your insurance company and outlines the details of a service you received, including the date of service, description of the service, who performed the service, what was charged for the service, what was the amount allowed to be paid for the service (the agreed upon rate between provider and insurance company), what insurance paid, and what you owe the provider (deductible, copayment, co-insurance). Often the charged amount is higher than the allowed amount. For in-network services, this charge is not passed on to the patient. However, it is possible for an out-of-network provider to “balance bill” the patient if a service is not fully covered by the insurance.

You can use your EOB to make sure the bill you receive from your healthcare system or provider is correct. If your EOB and bill do not match, you should figure out what is causing the discrepancy by contacting your insurance company and/or the provider’s billing office before you pay your bill. Your insurance company will never bill you for medical services; bills come from the healthcare system or provider that performed the service.

Sometimes you may receive communication from your insurance company that a particular service is not covered or that they are working out a request for coverage with your provider. These types of communications are different from an EOB. If you receive a communication from your insurance company regarding your coverage and do not understand the details in the communication, it is important to contact them to have your questions answered.

Tip: You can call your insurance company and/or the billing department (usually their contact info is right on the bill or EOB) if you have any questions about your bill or EOB. They can be very helpful to assist you in understanding your charges and coverage and answer any questions you may have.

Health savings account (HSA): An HSA is a special savings account that allows you to save pre-tax money to pay for medical expenses. Only people with high deductible health plans (HDHP) can open an HSA. Money deposited in an HSA is completely tax-free and can be used to pay for approved medical expenses. Money not used in a given year will roll over to the next year, but there are limits to how much a person can deposit into the account. You may need to submit your medical receipts to your HSA administrator to have your bill paid or reimbursed with your HSA funds. An HSA is “portable” meaning that it stays with you if you change jobs.

Flexible spending account (FSA): A flexible spending account (also called flexible spending arrangement) is similar to an HSA because it allows you to save a certain amount of pre-tax money to cover medical expenses. However, there are limits to how much money, if any, can roll over if you don’t use it all in any given year. An FSA is only available through an employer, so if you have an FSA through your work, you may lose the money in your account if you change jobs. You do not have to have a high deductible health plan (HDHP) to qualify for an FSA.

Resources

(You may want to come back to these over time as your understanding of health insurance grows)

https://www.youtube.com/watch?v=-58VD3z7ZiQ

https://www.kff.org/health-reform/video/health-insurance-explained-youtoons/

https://kidshealth.org/en/teens/insurance.html

https://www.schplugs.org/wp-content/uploads/PLUGS-Complex-Lab-Tests_2020.pdf

https://www.investopedia.com/best-cancer-insurance-4843757

https://www.thebalance.com/best-cancer-insurance-4169725

https://www.verywellhealth.com/best-cancer-insurance-5113097

https://quotewizard.com/health-insurance/cancer-insurance

https://www.insurance.com/health-insurance/health-insurance-basics/cancer-insurance.html

FAQs

There are many different insurance plans available, and it’s not easy to know which one to pick.

Weigh the pros and cons of each plan. If your healthcare plan is through your employer, your employer will often provide information on the insurance plan (i.e.: what they cover, what they do not, costs) including insurance brochures, fee schedules, and websites. You can also go directly to an insurance plan’s website to get more information. Do not hesitate to call your employer’s benefits office to ask them questions – this can be very helpful! Speaking to the insurance company you are considering may be helpful as well. Make a list of questions you have about the plan before you call. If you are self-employed, you can get information from various healthcare plans’ websites. If you are shopping through the Health Care Exchange for Affordable Care Act (ACA) insurance, their website (https://www.healthcare.gov/) has many helpful tools and lots of good information. You may also want to Google search your state and “health insurance” to find more information about health insurance coverage options in your area. Keep in mind you may be eligible for Medicaid or other types of insurance in which some or all of the costs may be reduced or covered. You can find out more about whether or not you may be covered under these healthcare plans by going to Healthcare.gov, by searching your state Medicaid plans and insurance sites, or by talking to your healthcare provider. Sometimes your hospital may have advocates or financial counselors who can help you with this, as well.

Tip: Whenever speaking to anyone at an insurance company, make sure to get their name and keep a brief note of who you talked to, what you talked about, and the date. This can be very helpful if you need to clarify or address things in the future.

People with LFS may want to explore a few things in particular when shopping for insurance plans:

Finding the right balance between deductibles and copays: You’ll want to make sure you can afford the insurance and that it is as cost-effective as possible for you. This includes balancing what you have available month to month (to pay for monthly premiums) and what you can afford if something big comes up (paying your deductible and out-of-pocket max). Some insurance plans offer low monthly premiums but have high deductibles and out-of-pocket maximums. These are called “high deductible” plans. Some young, healthy individuals are enticed by these ‘low cost’ plans because they feel the month-to-month savings are worth the risk of having a high deductible. However, high deductible plans are not advised for people with LFS because the costs of screenings and, if needed, cancer treatments can be very expensive each year. This means that while you may end up spending less each month on your insurance plan, if you are obtaining your annual cancer screenings including whole body MRI or if you get sick or need an expensive procedure, you can end up paying most, if not all, of that cost which can easily reach hundreds to thousands of dollars depending on your deductible. Other plans are “zero deductible” or lower deductible plans. Lower deductible plans can be good because you usually end up paying a lot less out-of-pocket before things start getting covered, but they often are more expensive month to month (have a higher monthly premium). If you can afford a zero deductible plan, and the out-of-pocket maximum is manageable in case of a high expense year, these plans can be a great option. With a zero deductible plan, your coinsurance comes into play immediately, so you are never paying 100% of a covered cost. There are many other plans as well, each with their own pros and cons.

Find out about the plan’s coverage of imaging/radiology: Most of the screening (and cost) for LFS surveillance comes from imaging studies, particularly MRIs, ultrasounds, and other scans. When shopping for insurance, look specifically at their coverage for imaging or radiology. You can find this information on the plan website (or sometimes in the insurance information provided by your employer) under terms like “Plans and Coverage,” “Fee Schedules,” or “Consumer Health Plan Brochures.” If you can’t find it, you can call the insurance company and they can help you locate it. These are often large, multi-page documents that lay out the coverage for every possible type of medical service offered by the plan (or plans) the insurance company has. You can look at the table of contents or do a word search for “imaging” or “MRI” to find the relevant sections that detail the coverage for imaging. It may also be worth checking to see if the insurance plan distinguishes between “diagnostic” and “screening” imaging and what the coverage and costs are for each of these. Once you know what the costs and coverage would be for your imaging that can help you compare across plans to see what may be the best option for you. If you have any questions about the coverage or things you read in the brochure, call the insurance company and ask!

You may also want to consider calling the insurance company ahead of time to see if they offer coverage for any other tests and procedures you routinely have. They may require you to have a procedure code (CPT code) in order to give you the most accurate information. You can usually ask your provider for that. It is important to know that the coverage the insurance company quotes you ahead of time is not a 100% guarantee, but it can help give you a ballpark.

You can also talk to your doctor, genetic counselor, or the billing department of the hospital where you will receive your scans to get advice from them on which insurance companies or plans tend to reimburse for these tests. They may not know this information, but it can’t hurt to ask!

Consider the difference between different types of plans: There are several different types of healthcare plans (see “Types of Plans”) that each have their own benefits and weaknesses. For instance, PPO plans can often be a good choice because they provide the most freedom. You can make appointments to see any doctors without referrals and have the most flexibility in where you can go and who you can see. If you stay in-network, things will be cheaper. However, they tend to be more expensive. And if you have a great doctor or oncologist who you trust to make all of your referrals for you then the extra flexibility of a PPO plan may not be worth the costs. On the other hand, HMO plans tend to be cheaper, but you often can’t see specialists without getting approval (a referral) from your Primary Care Provider. This can sometimes be less than ideal for someone with a health problem like LFS who needs to see lots of specialists, or who doesn’t have a close relationship with their Primary Care Provider that allows them to make quick and adequate referrals to the right specialists.

Ask about exclusions: Some insurance plans have complete exclusions for coverage of certain tests and procedures. Another way this may be termed by the insurance company is “covered benefits” and “non-covered benefits.” For instance, some companies may have a policy for an exclusion on genetic testing and will not cover genetic testing under any circumstances. Rarely, there may be an exclusion on whole-body MRI. Calling the insurance company and asking about this may help you learn more. It can also be useful to ask them if they have policy guidelines for surveillance and management for individuals with Li-Fraumeni Syndrome; some insurance companies have specific guidelines for this, but many do not.

Tip: The coverage and costs for insurance plans may change from year to year. Even if you stick with the same plan, check and make sure nothing has changed! You will likely want to do this BEFORE you renew your plan just in case things change so much that you may want to shop for a different plan.

As a child, adolescent, and even a young adult, it is very common to be covered by your parents’ health insurance. In the United States, a person can stay on their parents’ plan up until age 26.

One of the most common ways to get health insurance after you’ve left your parents’ plan is to have insurance through your employer. Many employers offer health, vision, and dental insurance as part of their benefits packages. Usually, they will offer a few different plans at different prices all through the same company. Make sure to do your research on each of these plans and pick the one that is best for your situation and most likely to cover your annual scans (see “Which type of insurance plan is best for me?”). A major benefit of being insured through an employer is that they usually cover at least a portion of your monthly premiums.

If insurance through an employer is not a good option for you and you are a U.S. citizen, you can visit https://www.healthcare.gov/ to look at health insurance options through the Health Insurance Marketplace. This website will direct you to the options available to you in your state and will also let you know if you might be eligible for certain government-funded reduced-cost options such as Medicaid or CHIP.

Secondary insurance is purchased in addition to your primary health insurance to provide additional coverage of medical services. Two very common types of supplemental health insurance plans are vision and dental insurance plans, which are commonly offered through employers and can also be purchased on the Health Insurance Marketplace (https://www.healthcare.gov/). For individuals with Medicare, another common secondary insurance is a supplemental Medicare plan (also known as a Medigap policy) to help with costs not covered by Medicare alone. People with cancer or cancer predisposition syndromes like LFS may be interested in secondary cancer insurance which provides some additional benefits for cancer-related healthcare costs. You can find quotes for cancer insurance and other types of secondary insurance by visiting the websites of insurance companies that offer that type of secondary insurance. See the “Resources” section of this guide for links to information on cancer insurance.

It is important to know that secondary insurance plans are not held to some of the same legal standards as primary health insurance when it comes to discrimination based on pre-existing health conditions and there is a small possibility you may not be found eligible for a secondary insurance plan because of this. If you are turned down based on a pre-existing condition such as a cancer or your LFS diagnosis, you can see if you qualify for a plan from a different company.

This will depend on your specific health insurance plan. Usually, if you meet genetic testing criteria or it is known that there is a TP53 variant in your family, an insurance company will recognize that the test is medically necessary. However, you may still be responsible for a portion of the test cost depending on factors such as your copay, coinsurance, and deductible. Some patients pay nothing at all out-of-pocket for genetic testing, and some testing laboratories will offer free testing if you had a relative who tested positive through their lab recently. Most patients pay less than $100 after insurance coverage, but once again this can vary. Many labs also offer patient-pay options (usually around $250) which bypass insurance altogether. These can be helpful for individuals who have no insurance, have high deductibles, or whose insurance does not plan to cover testing. Most labs also have financial assistance programs to help offset the cost for those who cannot afford testing.

Even if your genetic testing is covered, you will likely have an office visit charge for your visit with the genetic counselor or healthcare provider for the appointment to discuss and perform your testing, as well as any lab related fees for things such as blood draws for the sample for genetic testing. Typically, these visits will be covered by your insurance similar to other medical visits. However, any costs to you for these testing-related appointments will depend on your specific insurance plan coverage.

As with any test or procedure, if your insurance denies coverage, you and/or your provider can appeal the decision and make a case for why it is medically necessary (see “Resources: How to Submit an Appeal”).

It’s important to discuss any cost concerns you have with your doctor, nurse practitioner, or genetic counselor before your genetic testing is performed and you are faced with a bill. If you are concerned about potential out-of-pocket costs, there are ways to run a pre-authorization before testing to get a clear estimate from your insurance company of what you would be expected to pay.

No. In the United States, it is illegal for a health insurance company to raise your premiums or deny you coverage because of a genetic test result or family history. This is outlined in the Genetic Information Nondiscrimination Act, also known as GINA. HIPAA (the Health Insurance Portability and Accountability Act) Title I health insurance reform also protects individuals from being denied insurance based on certain “health factors,” including genetic information, and protects health insurance coverage for individuals who lose or change jobs through special enrollment opportunities. GINA also protects against genetic discrimination by an employer, such as making hiring or firing decisions, as long as the company has at least 15 employees.

GINA does not protect against use of genetic information in determinations for life insurance or long-term disability insurance. GINA also does not apply to those serving in the military, so certain genetic test results could impact someone’s ability to serve in certain capacities.

See the “Resources” section of this guide for links to more information on GINA.

Insurance companies use billing and diagnosis codes to determine coverage. Billing codes are called CPT codes. Diagnosis codes are called ICD codes.

For example, if a doctor needs to order an X-ray of your broken wrist, they will probably use the 73100 CPT code (X-ray of wrist) with the S62.90XA ICD code (fracture of wrist). Your insurance will recognize that the x-ray is medically necessary and justified, and they should cover it.

One reason it can be difficult to get insurance coverage for wbMRI is that it can take quite a bit of time for insurance companies to recognize the benefits of certain tests and incorporate them into their policies, especially when the test is expensive and the condition it is ordered for is rare. At this point, we have more than a decade of data reinforcing the effectiveness of screening by wbMRI in LFS. We expect that more insurance companies will recognize and cover wbMRI as a medically necessary order for people with LFS. We have seen improvement in coverage over the years, but it will still take some time and continued efforts to educate insurance companies for this to become more widespread. The Li-Fraumeni Syndrome Association (LFSA) has been involved in these education efforts to expand coverage.

Another reason why coverage can be difficult or may vary across institutions is that there is currently no uniform CPT code (procedure code) for wbMRI. As wbMRI becomes more common and more uniform across institutions, it may receive its own CPT code.

Some physicians and hospitals may not have much experience with ordering wbMRI and therefore may not know the best codes to use or how to justify their reasoning to insurance companies. This is why it can be helpful to go to physicians and centers who have lots of experience screening LFS patients, although that is not always possible. If your hospital is less experienced with LFS screening, they may also choose to reach out to a more experienced screening center for suggestions and guidance on how to get started (see theLFSA Medical Resources page for medical contacts at LFS screening centers).

When your friends take the bill at a restaurant and say, “We’ve got you covered,” that usually means they are paying for your meal. You don’t have to worry about it, and you don’t have to pay them back.

Unfortunately, that’s not exactly what an insurance company means when they say, “your scans are covered.” “Covered” means that the test or scan you will be getting falls under the contracts established between you and your insurance company. The insurance company acknowledges the scan as medically necessary. They will pay their share of the scan as outlined in your insurance policy, and they expect you to pay your share.

What is your share, exactly? Your share depends on certain aspects of your insurance policy such as your deductible and your coinsurance. You may be expected to pay up to 100% of the costs until you reach your deductible; then you would pay a smaller fraction.

See “How can I know if health insurance will cover my whole-body MRI and what I should expect to pay?” below for more information.

The first step is to be familiar with your health insurance coverage policies for imaging (see “Which type of insurance plan is best for me?”). This can help you understand what is covered, what is not, and what the associated costs likely will be.

When your wbMRI is ordered or scheduled, the hospital billing department may file a pre-authorization with your insurance. (In case this is not standard protocol at your hospital, it is a good idea to specifically request that they do this ahead of time and that they notify you of the results and any estimated out-of-pocket cost.) Your provider’s office will tell the insurance company what CPT code(s) (procedure codes for billing) will be ordered and what ICD codes (diagnosis codes) are being used to back up the need for the test. The insurance company will look at your policy and will let the hospital know whether the procedure is covered for the reasons given and, if covered, what amount of the cost you will have to pay out-of-pocket (as determined by co-pay, coinsurance, deductible, etc. from your plan). If you have concerns about the cost and/or coverage of your wbMRI, it is important to discuss this with your doctor, your center’s billing department, and your insurance company before the procedure and before you have a bill.

You can let your provider ordering your scans know that you have questions or concerns about insurance coverage and out-of-pocket costs and see if they have any suggestions for you based on your specific location and hospital.

You can also call your insurance company directly using the number on the back of your insurance card. The “wbMRI Coverage Worksheet” at the end of this resource can help walk you through these steps. If you plan to do this, you should request the CPT code(s) and ICD codes (most of the time, the ICD-10 code should include Z15.01 for Li-Fraumeni syndrome/Genetic susceptibility to malignant neoplasm) from your provider ahead of time, as well as the name of the medical center and doctor who would order the scan, so you will be prepared with the information when you call. Hospital billing departments can often be very helpful with this, as well. Some hospitals have Financial Navigators or other helplines to help you through these types of coverage questions and to help you understand what you may expect to pay from scans such as wbMRI.

Another option some insurers recognize for payment of whole-body MRIs is the submission of CPT code 76498 – magnetic resonance procedures that do not have any other specific code, which includes whole-body MRIs that the provider uses to perform a diagnostic procedure to diagnose a condition or an interventional procedure to treat a condition.

There are a number of actions you and your provider can take following an insurance denial for wbMRI.

The first option is to petition the denial and/or request a peer-to-peer review. This requires your doctor to appeal with a letter of medical necessity or, if necessary, have a direct conversation with a medical provider from the insurance company (this is called a peer-peer review). Your doctor would explain why the scan is important and would lay out a case for coverage. Ideally, the insurance team will recognize the importance of the test after the conversation and agree to cover it. It is often important to do this within a certain time period after the scan is originally denied or the claim can be closed, and the process has to start all over again. See the “Resources” section of this guide for a link to more detailed information on how to submit an appeal.

If insurance still denies the scan, another option to consider with your doctor is performing separate MRIs – MRIs of individual portions of the body until most of the body is covered (e.g.: brain MRI, chest MRI, pelvic MRI, etc). (This is also an option to consider if you do not have access to a hospital that has wbMRI technology and expertise.) Although this is less ideal than wbMRI since it may not scan every part of the body and it cannot be done in one sitting, partial MRI scans are more common than wbMRI scans and may be more readily approved by insurance. They may be less or more expensive than a wbMRI depending on how the scans are ordered and how your insurance covers them.

If your doctor or hospital does not regularly order wbMRI scans or treat other patients with LFS, another good resource would be to reach out to other established LFS clinics that might have more experience ordering and getting coverage for wbMRI. Their doctors or billing departments might have specific recommendations to facilitate coverage. Again, you can reference the LFSA’s Medical Resources.

Finally, if you are stuck with a large bill for your wbMRI (or any other test or procedure) do not hesitate to call the billing department (usually the number located on the bill itself). The billing department can usually be very helpful in helping you to pay a bill. Often, you can discuss options to break the payment into smaller chunks in a payment plan. Some hospitals offer patient “pay discounts,” or offer a price discount if the patient agrees to pay everything up front. You can also ask if your hospital or center has a financial navigator or other helpline to assist you.

Tip: If you are having trouble with payments or concerns about a bill, do not panic and definitely call the billing department and insurance and explain your situation. If it is clearly documented you are working on a solution, that will help make sure your bill does not go to collections and oftentimes they can help you with some solutions. And remember to write down the names of who you spoke to, the date, and what they say!

If none of these options work, you may want to consider changing your insurance plan or provider to one that does cover wbMRI screening for LFS.

There are many different types of life insurance policies and applications. Some policies last only for a certain period of time (term life insurance); some last forever (whole life insurance). Some applications require extensive medical information and even access to review your medical records; others require simple yes/no answers to a short list of questions. The way life insurance works is that you pay a monthly fee for the period of time your policy lasts, and if you happen to pass away during that time, your beneficiary will receive a certain sum of money as specified by the policy. Usually, the more money your policy is worth, the more you have to pay each month – all of this is outlined in the contract that you agree to. If you don’t like the policy terms you are offered by a company, you do not have to sign the contract, and you can look for a different company. Although life insurance companies can ask about your health information before they’ve offered you a policy, they cannot raise your premiums due to new health information after a policy is already in place. As referenced earlier, protections offered by GINA are not applicable to the purchase of life insurance as they are for health insurance.

It’s important to know that just like the rest of your medical history, your genetic testing information is not off limits to life insurance companies. They may or may not ask about genetic testing when you apply for life insurance, but if they ask for that information, you will need to answer truthfully. If you have positive genetic testing for LFS, there is a chance you could be asked to pay more for a policy than a similar individual who does not have an LFS diagnosis. If asked and fail to disclose positive genetic testing for LFS, you could be committing insurance fraud.

Because of this, some people choose to get life insurance before they have genetic testing for LFS or to purchase policies for their children before testing them for LFS. This is a personal choice. Obtaining life insurance for minors is typically a less involved and more affordable process than obtaining life insurance later in life.

See the “Resources” section of this guide for more information on life insurance.